Posted on October 9, 2014 at 12:29 pm by Nigel Brokenshire

Securing the best home insurance deal

The challenge was to determine which of the following provides me the best value (cost, coverage & experience) for my home, buildings and contents insurance

- Stick and renew with same provider

- Switch by using an online comparison site

- Gamble by responding to a cold call, or

- Play safe and seek independent insurance advice

Could I find the same cover and at a cheaper price? Where would this be from? How long would it take me?

The contenders and how they performed

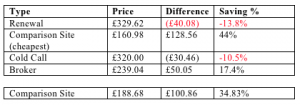

1. Renew with same provider. A straight ‘like for like’ policy renewal was offered at £329.62 an unhealthy increase of 13.8%. With the quote stating “your lowest annual quote from our panel of insurers” meant I felt uninterested to ring and ask ‘can’t you do better’?

Outcome: forget it; too expensive

2. Comparison sites. After using two well-known UK comparison sites and spending on average 10 minutes each time to receive quotes, I was pleasantly faced with:

- 50+ quotes from each comparison search

- 20+ quotes both times, cheaper than last year’s policy

- the cheapest quote (same particulars) was only £160.98 and with legal protection included!

Outcome: huge selection of choice, fairly easy to add & compare; but watch out for amendments (see tips section)

3. Cold contact from post and phone. At the time of reviewing the policy we had two ‘estimates’ in the mail, one for £209.79 (including a £50 cashback after 70 days) and another for £213.80 (fixed for two years… new to me).

Both provided 0800 (free call numbers) but knowing I had to add additional cover, and the online quotes were already £50 cheaper I decided not to call. I was not keen to spend my time on the phone giving them my details, then knowing they will continue contacting me.

I was also cold-called one afternoon and after spending 30 minutes providing my details, answering questions, waiting to be put through to two different people (seems the caller can’t make a decision themselves and needs ‘authorisation’ to do any negotiation) they offered a best deal of £320.

Outcome: nice try, but do question “what is really included”, do I have time to call? Do I want them to keep contacting me? No, thank you.

4. Independent FCA broker. I have used an advisor before so sent them an email listing my requirements. They were quick to respond, enquired about finer points and came back within a couple of hours with a quote of £239.04 (£50 saving from last year and also included accidental damage cover). This was followed up by a call as well.

Outcome: pleased to know my specific needs are being met and fairly competitive pricing

The winner is…

We went for the same level of cover, same level of excesses, with a new insurance provider at a cost of £188.68.

An impressive saving of £100.86 (34.83% saving) from last year’s £289.54

This was sourced from a comparison site and in fact was not the cheapest (top of the list) one offered.

It included additional Home Emergency Cover and entitles us to a one night hotel stay for two adults, from over 100 hotels UK-wide (if still on the cover after 60 days).

This was achieved by spending less than 20 minutes from the initial search through to final decision.

Take home tips

Renewals are a major no no. If you don’t switch, you will pay for it. If we had done nothing, we would have overpaid by £140 for this year!

You need to determine the amount of effort you want to spend, finding quotes, comparing the details and making a decision. I didn’t approach providers who do not feature on comparison sites, as I had made a personal decision on how far I was to go to research the market.

Check, check and check again the saved comparison site parameters. I had to ensure voluntary excess was set right and other fields hadn’t changed. In my case they had and I felt uneasy having the total excesses at £250 for a single claim. http://www.theguardian.com/money/2014/jul/16/price-comparison-sites-criticised-failings

Use multiple comparison sites to ensure you get the best deal. Comparison sites seemed to be the winner, in 10 minutes you have new (cheaper) insurance policies to choose from, however… you need to be cautious of limitations/exclusions and those not offering the best deal http://www.thesundaytimes.co.uk/sto/business/money/Consumer/article1464052.ece

Cold call contacts are’ finger in the air’ estimates. They still require you to provide all your details, taking time and for little gain. What is more concerning is how did they know my insurance was up for renewal?

Broker/advisors, are not all the same, but find a good one and they will do their best to match or beat the market. They answer your queries, customise a policy to meet your requirements and have the same access to major providers. They are more helpful for specific cover like landlord or commercial insurance.

What are you experiences and advice regarding home insurance renewals? Leave us a comment in the box below!